Which is Better, Renting or Buying?

The Financial Benefits of Owning Real Estate

Whether you're a first-time homebuyer, looking to purchase a second home, or considering assisting your adult children in buying a home, owning real estate can offer significant long-term financial benefits. While renting may be a more immediate and accessible option, the benefits of homeownership can outweigh the temporary convenience of renting.

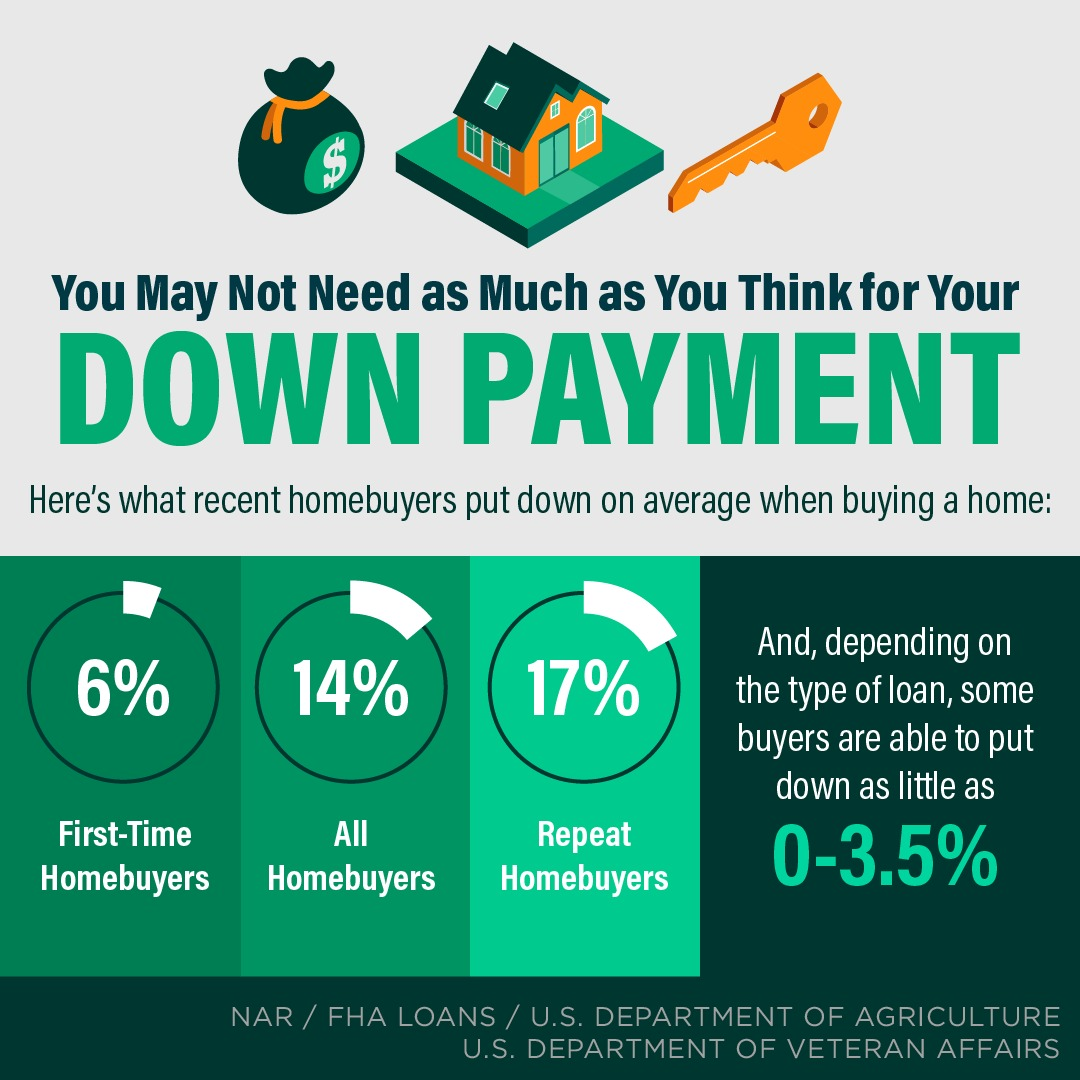

In becoming a homeowner, you'll need to have a stable employment history, good credit, and some form of down payment. While having a sizable down payment can be beneficial, there are many loan programs available that require only 3-5% down. Additionally, your nest egg that you would put into a home purchase is a powerful investment vehicle that can lead to significant financial growth and security over time. Read on to discover more benefits in owning, and check out the video link from Matthew Gardner, Windermere's Chief Economist, who also weighs in on this subject.

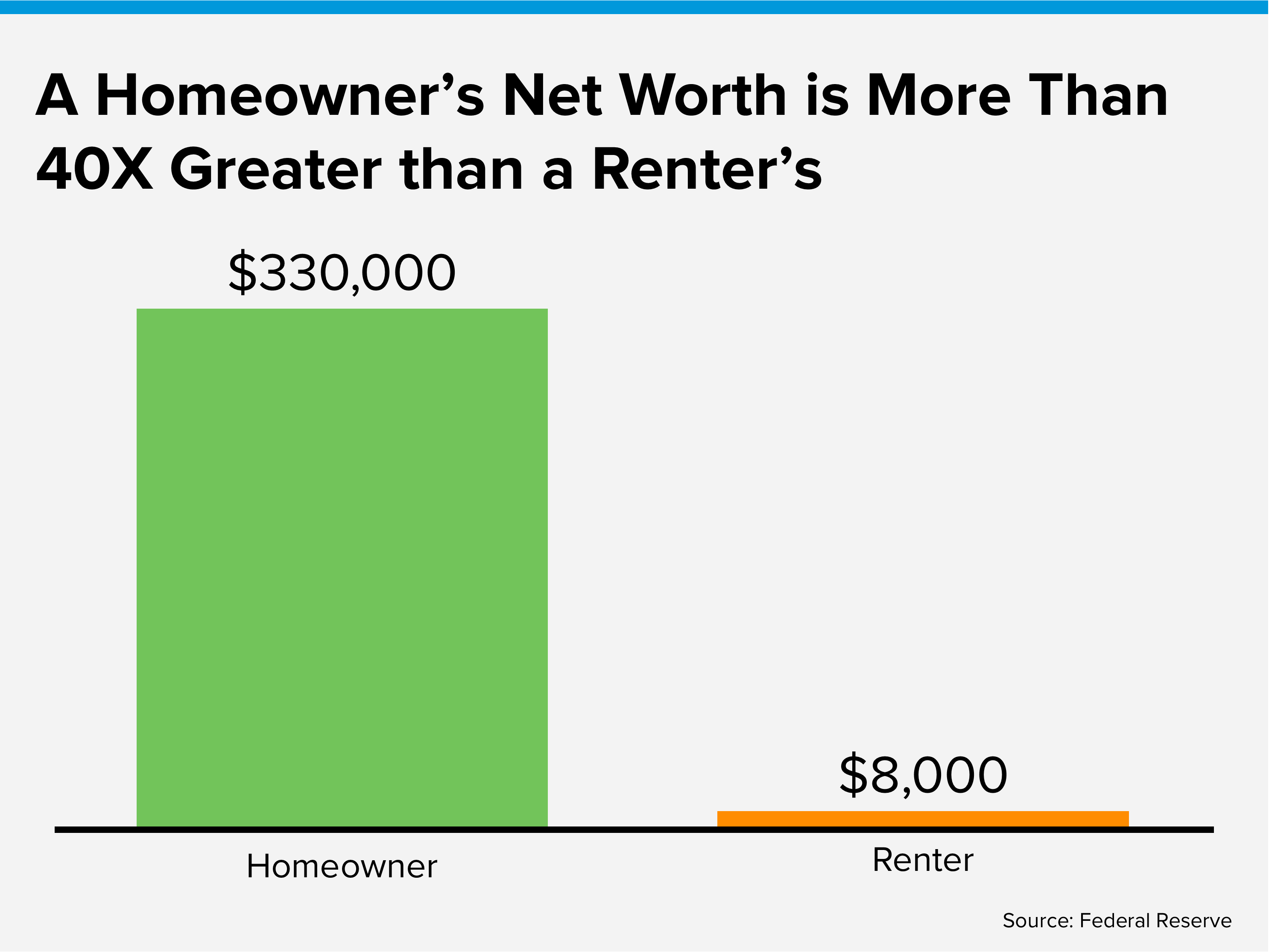

Did you know that the average net worth of a homeowner is 40 times higher than that of a renter? This statistic alone shows the incredible financial benefits of owning real estate. As a homeowner, you have the opportunity to build equity over time and benefit from historical home price appreciation, which has averaged 3-5% annually. While there may be occasional dips in the market, real estate is a solid long-term investment that can provide shelter and financial opportunity.

One of the biggest advantages of buying a home is that every mortgage payment goes towards paying down your loan principle, essentially serving as a forced savings account. Unlike rent, which provides no return on investment, owning real estate allows you to allocate a portion of your income towards an asset that is growing in value. Additionally, it provides tax benefits such as real estate tax and mortgage interest deductions, as well as capital gains tax exemptions on a primary residence.

If you already own a home and are considering purchasing a second property, diversifying your investments by adding another property to your portfolio can be very valuable. Real estate provides tangible benefits such as the ability to make improvements to the property and enjoy them while increasing the value of the asset. It also provides the opportunity to generate rental income or flip the property for a profit.

If you are considering assisting your adult children with purchasing a home, it can be a wise financial decision that can benefit them in the long run. Not only can it provide a place for them to live while they build their own financial stability, but it can also serve as an investment tool for their future.

I will leave you with this: it can seem overwhelming to take on the task of buying another home or to help prepare your adult children to purchase. Start by shopping in an affordable price range. Often people want to get their forever home right off the bat and that makes the accomplishment of becoming a homeowner much harder. Figure out how much you can afford now and put your nest egg to work sooner rather than later to start building wealth. Maybe it is a small condo that fits your budget now, but over time the money saved and the equity built can turn into the down payment needed to purchase your forever home.

Investing in real estate is a step-by-step journey that takes time and sacrifice. Your patience and commitment will be rewarded with compounded savings which will lead to building long-term wealth. It also creates a fond memory lane of that first condo or small house that you loved making a home, which then becomes the vehicle to afford the next home that better suits your lifestyle. If you are curious about the prospect of owning additional real estate or have a special person in your life who is poised to become a homeowner, please reach out. It is my goal to help people understand the process, align them with a trusted lender, help them make strong financial decisions, and match their living situation to their lifestyle.

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Saturday, April 15th, 10AM to 2PM*

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

This is a paper-only event. No x-rays, electronics, recyclables, or any other materials.

We will also be collecting non-perishable food and cash donations to benefit Volunteers of America Western Washington food banks. Donations are not required, but are appreciated. Hope to see you there!

*Or until the trucks are full