Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Now or Later: When Interest Rates Drop…

The question that many potential buyers are asking themselves right now is: should I wait for rates to drop before I buy? Higher interest rates have certainly made monthly payments higher and challenged overall affordability, however it is important to consider creative financing options and what the impact on prices will be once rates lower.

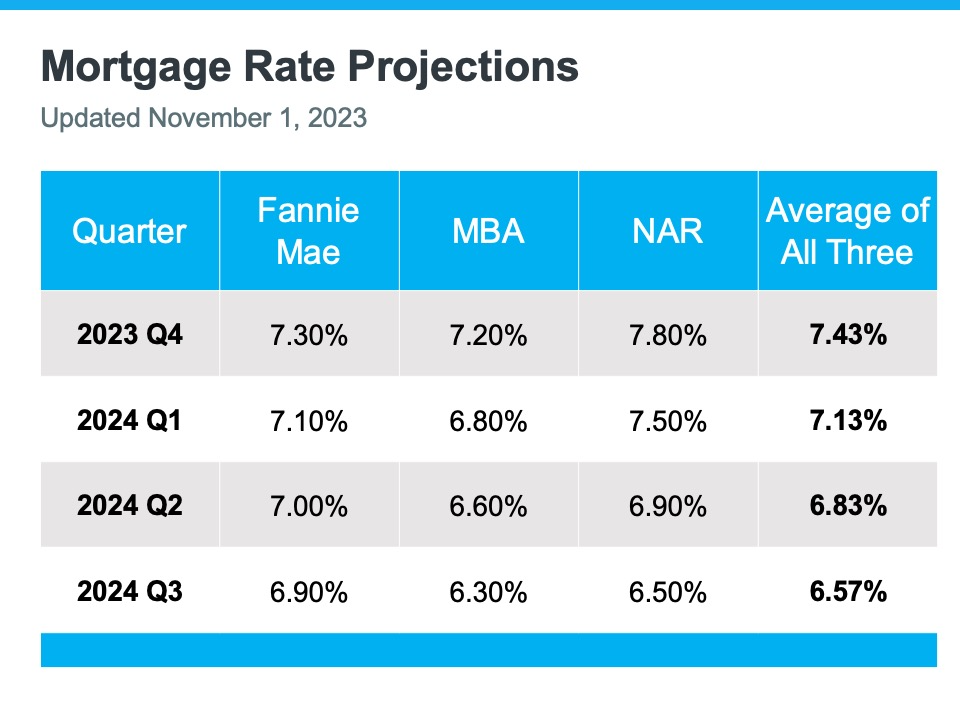

Experts predict rates to decrease over the next 12-18 months. In fact, we have seen rates drop half a point over the last 30 days. Currently, the 30-year conventional rate is hovering about 7.5%. We saw a correction in prices when rates jumped by a point and crested 6% in mid-2022. Since Dec 2022, prices found their bottom, and price appreciation started happening again. Year-to-date, the average interest rate has been around 7% and prices have not been in a free fall, they have grown and remain stable.

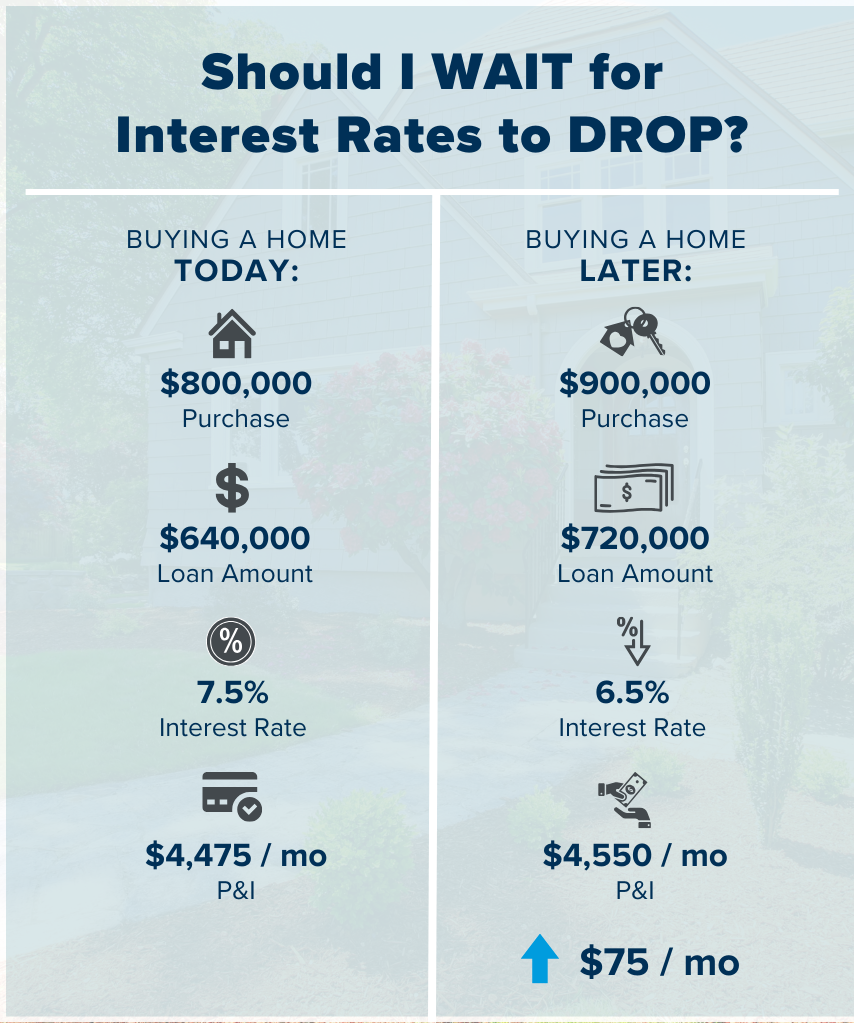

Just like the correction that happened in 2022, it is safe to say there is a correlation between prices and rates. If the experts are correct and rates fall over the course of the next year or so, we should anticipate prices to increase. That is what hangs in the balance when making the decision of whether to buy now or later. The example to the right shows the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

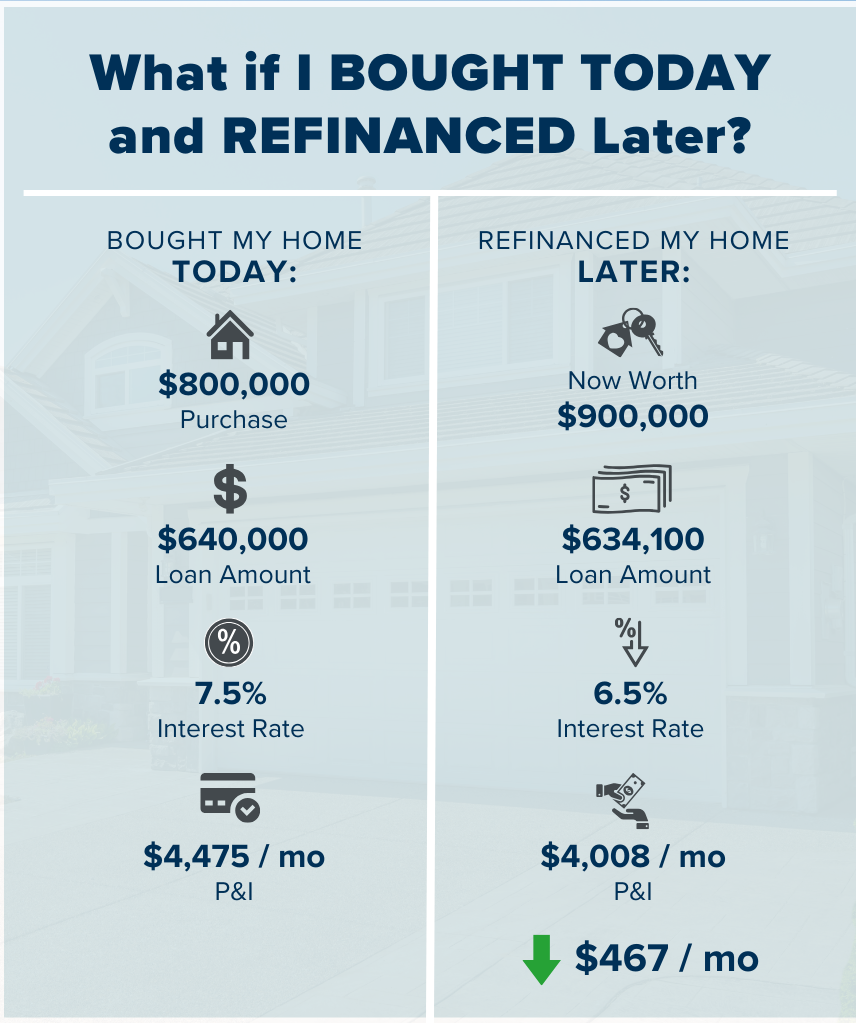

If one is able to afford a purchase now with today’s rate, they can refinance when rates go down and save themselves a lot of money on their payment while keeping a fixed price. Additionally, if a buyer can secure a rate buydown, such as a 2-1 buydown, the higher rates can be overcome and a refinance can fix the rate when the rates drop.

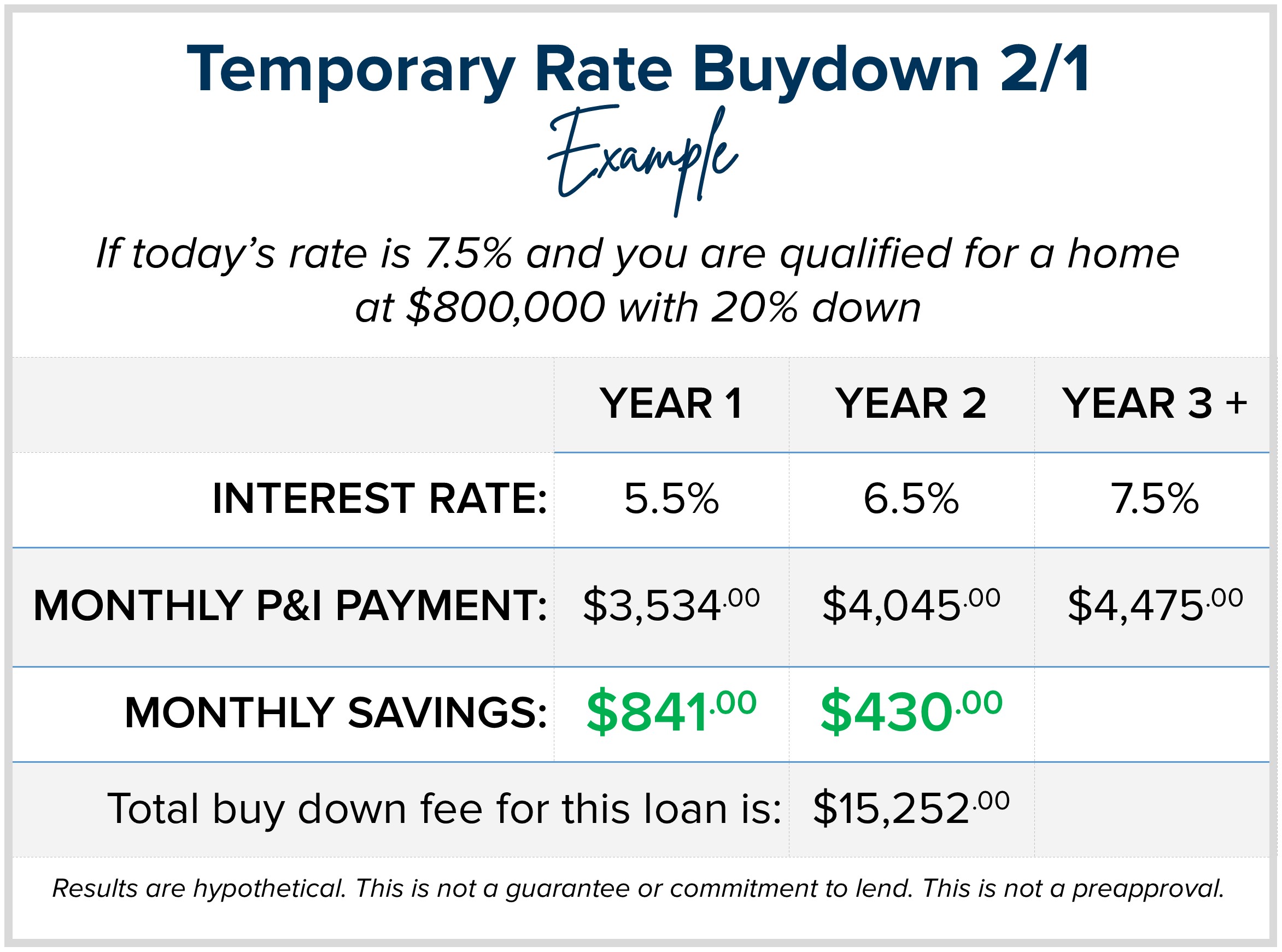

Here is an example: let’s say you are shopping for a house and have the same $800,000 budget and a 20% down payment with today’s rate of 7.5%. The monthly principal and interest payment would be $4,475.00. You could do a 2-1 buydown (2-points lower in year one and 1-point lower in year 2) which would have your payment in year one be based on an interest rate of 5.5% with a monthly principal and interest payment of $3,534 – a savings of $841.00 per month. For year two, the monthly principal and interest would be based on 6.5% resulting in a monthly payment of $4.045.00, a $430.00 per month savings. The total savings in monthly payments with the 2-1 buy-down over the two years would be $15,252.00.

The roughly $15,000 in monthly payment savings is paid upfront at closing and in some cases paid by the seller. The buyer still needs to qualify based on the 7.5% interest rate as the payments will convert to the payment based on the 7.5% in year three moving forward. The strategy here is to never have the payment increase to 7.5% because the buyer plans to refinance when rates come down, and will permanently fix their rate below 7.5%. A bonus is that if the entire $15,000 credit has not been used yet, in some cases those funds can be applied towards the refinance.

You see, there are many options to consider when a buyer is balancing rates, prices, payments, and their desire to make a move. I understand that I am in the business of helping people navigate big life changes while ensuring their financial investment is sound. I felt it was an important message to share these examples in case you or someone you know was thinking about making a purchase but was feeling confused or stifled by the current rate environment. If you want to learn more or need a referral to a reputable lender, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions.

The question that many potential buyers are asking themselves right now is: should I wait for rates to drop before I buy? Higher interest rates have certainly made monthly payments higher and challenged overall affordability, however it is important to consider creative financing options and what the impact on prices will be once rates lower.

Experts predict rates to decrease over the next 12-18 months. In fact, we have seen rates drop half a point over the last 30 days. Currently, the 30-year conventional rate is hovering about 7.5%. We saw a correction in prices when rates jumped by a point and crested 6% in mid-2022. Since Dec 2022, prices found their bottom, and price appreciation started happening again. Year-to-date, the average interest rate has been around 7% and prices have not been in a free fall, they have grown and remain stable.

Just like the correction that happened in 2022, it is safe to say there is a correlation between prices and rates. If the experts are correct and rates fall over the course of the next year or so, we should anticipate prices to increase. That is what hangs in the balance when making the decision of whether to buy now or later. The example to the right shows the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

If one is able to afford a purchase now with today’s rate, they can refinance when rates go down and save themselves a lot of money on their payment while keeping a fixed price. Additionally, if a buyer can secure a rate buydown, such as a 2-1 buydown, the higher rates can be overcome and a refinance can fix the rate when the rates drop.

Here is an example: let’s say you are shopping for a house and have the same $800,000 budget and a 20% down payment with today’s rate of 7.5%. The monthly principal and interest payment would be $4,475.00. You could do a 2-1 buydown (2-points lower in year one and 1-point lower in year 2) which would have your payment in year one be based on an interest rate of 5.5% with a monthly principal and interest payment of $3,534 – a savings of $841.00 per month. For year two, the monthly principal and interest would be based on 6.5% resulting in a monthly payment of $4.045.00, a $430.00 per month savings. The total savings in monthly payments with the 2-1 buy-down over the two years would be $15,252.00.

The roughly $15,000 in monthly payment savings is paid upfront at closing and in some cases paid by the seller. The buyer still needs to qualify based on the 7.5% interest rate as the payments will convert to the payment based on the 7.5% in year three moving forward. The strategy here is to never have the payment increase to 7.5% because the buyer plans to refinance when rates come down, and will permanently fix their rate below 7.5%. A bonus is that if the entire $15,000 credit has not been used yet, in some cases those funds can be applied towards the refinance.

You see, there are many options to consider when a buyer is balancing rates, prices, payments, and their desire to make a move. I understand that I am in the business of helping people navigate big life changes while ensuring their financial investment is sound. I felt it was an important message to share these examples in case you or someone you know was thinking about making a purchase but was feeling confused or stifled by the current rate environment. If you want to learn more or need a referral to a reputable lender, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions.

The Triangle of Buyer Clarity – Finding Buyer Success in a Seller’s Market

|

|

|

|

|

|

|

|

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link